Joining a credit union can be a game changer for your financial health. However, who exactly can join, and what’s the process? This guide aims to demystify the credit union membership process. Find out who can join a credit union and how to become a member below.

What Sets Credit Unions Apart?

Credit unions differ significantly from traditional banks. They are not-for-profit institutions, meaning profits benefit members rather than shareholders. This unique structure allows credit unions to offer lower fees and better interest rates. More importantly, it fosters a sense of community and mutual support.

Unlike big banks, credit unions are member centric. This means every decision, from loan approvals to community projects, prioritizes members’ needs. This people-first approach often results in exceptional customer service and personalized financial solutions.

Who Qualifies To Join a Credit Union?

Eligibility for credit union membership varies but is generally inclusive. Most credit unions set membership criteria based on common bonds. Common bonds can include geographical location, employer, or membership in certain organizations.

For example, if you live or work in a specific area, you may qualify to join a local credit union. Employers also sometimes establish credit unions exclusively for their employees. Additionally, many unions allow family members of current members to join, extending the benefits across generations. Regardless of the criteria, the overarching goal is to serve a particular community’s financial needs.

Steps To Become a Member

Joining a credit union involves several straightforward steps. First, identify a credit union that fits your eligibility criteria. Once you’ve found a suitable institution, the next step is to complete a membership application.

The application process usually requires basic personal information and proof of eligibility. This could be a utility bill showing your address or an employee ID card. Some credit unions may also require a small deposit to open your account. After submitting your application, you’ll receive confirmation of your membership.

How To Choose the Right Credit Union

Selecting the right credit union involves considering several factors. As we’ve mentioned, you first must ensure you meet the eligibility criteria. Next, evaluate the financial products and services offered.

Consider the institution’s reputation and community involvement as well. It’s also essential to assess the accessibility of branches and ATMs. Some credit unions are part of larger networks, providing more convenient access to your funds.

Additionally, review the available digital banking options. Take the time to visit potential credit unions, and speak with their representatives. This will give you a sense of the institution’s culture and customer service.

Membership Benefits

Becoming a credit union member comes with numerous benefits. Lower fees and competitive interest rates are just the beginning. You’ll also have access to personalized financial advice and community-focused services.

Credit unions often offer educational resources to help members improve their financial literacy. These can include workshops, online courses, and one-on-one counseling sessions. Such resources empower you to make better financial decisions.

Additionally, credit unions frequently invest in their communities. Whether through scholarships, grants, or volunteer opportunities, your membership directly contributes to community development.

Financial Products

Credit unions offer a range of financial products comparable to traditional banks. These include savings accounts, checking accounts, and various loan options. However, the terms and conditions are typically more favorable.

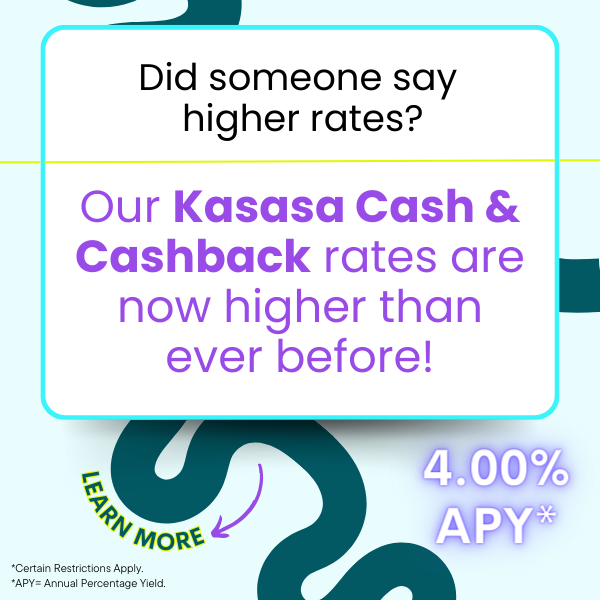

For example, credit unions typically offer lower interest rates on loans and higher interest rates on savings accounts. This can significantly impact your financial health, allowing you to save more and spend less on interest payments.

Furthermore, credit unions often provide specialized products tailored to their members’ needs. A credit union for health-care workers may offer a loan specifically designed to help with medical school expenses. On the other hand, a credit union for teachers may provide a special mortgage program for educators.

Personalized Financial Services

Personalized service is a hallmark of credit unions. Because they serve smaller, more specific communities, credit unions can offer tailored financial advice. This personalized approach ensures that you receive the best possible guidance.

Whether you’re looking to buy a home, save for retirement, or manage debt, credit unions can provide customized solutions. Their advisors take the time to understand your unique financial situation and offer recommendations accordingly.

This level of personalized service extends to every aspect of your banking experience. You can learn more about credit union services at Democracy Federal Credit Union.

Community Involvement

Credit unions are deeply rooted in their communities. They often sponsor local events, support charitable organizations, and offer volunteer opportunities. This community involvement fosters a sense of solidarity and mutual support among members.

By participating in these activities, you directly contribute to your community’s well-being. This not only strengthens community bonds but also enhances your sense of belonging.

Myths About Credit Unions

Several myths about credit unions persist despite their growing popularity. One common misconception is that credit unions lack the resources of larger banks. However, credit unions offer a full range of financial products and services.

Another myth is that credit unions are hard to join. In reality, many credit unions have flexible membership criteria. This inclusivity ensures that more people can benefit from their services.

Some mistakenly believe that credit unions have limited technological capabilities and outdated systems. But the truth is that many credit unions have invested in modern technology to provide convenient digital banking options for their members.

Finally, a common myth is that credit unions don’t offer competitive rates. On the contrary, credit unions often provide better rates due to their not-for-profit status.

The Future of Credit Unions

The future of credit unions looks promising as more people seek ethical banking alternatives. Their member-focused approach and community involvement make credit unions increasingly attractive.

Advancements in technology are also enhancing the credit union experience. From mobile banking to AI-driven financial advice, credit unions are at the forefront of innovation. These developments ensure that credit unions remain relevant and competitive.

Understanding who can join a credit union and how to become a member is crucial for anyone seeking better financial services. Credit unions offer numerous benefits, from lower fees to personalized service. Explore your eligibility today and experience the unique benefits of credit union membership at Democracy Federal Credit Union.